LTC Price Prediction: $150 in Sight as Technicals and Institutional Demand Align

#LTC

- Technical Breakout: LTC trading above 20-day MA and testing upper Bollinger Band signals bullish momentum.

- Institutional Catalysts: ETF speculation and Bitcoin's rally create tailwinds for further upside.

- Sentiment Alignment: News flow corroborates technicals, reducing risk of a 'bull trap'.

LTC Price Prediction

LTC Technical Analysis: Bullish Signals Emerge Above Key Moving Averages

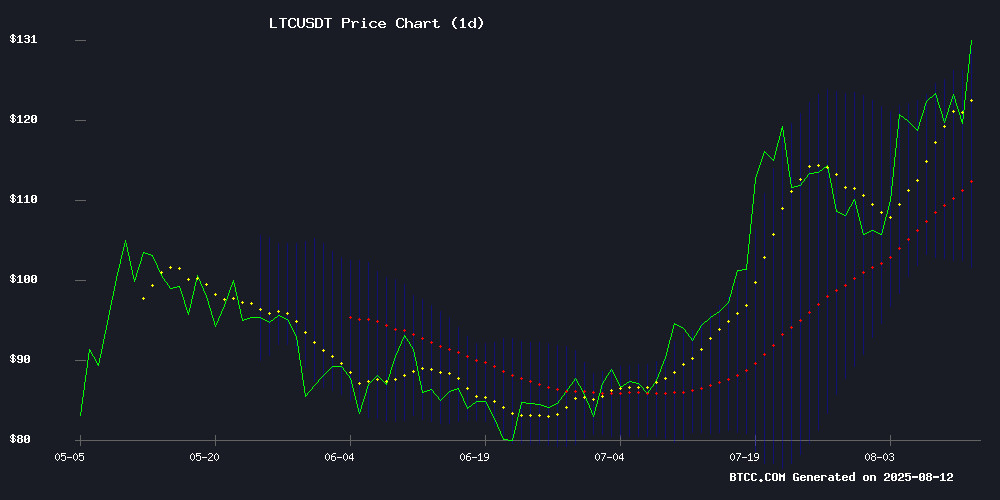

Litecoin (LTC) is currently trading at $120.05, firmly above its 20-day moving average (MA) of $115.17, signaling bullish momentum. The MACD histogram shows a narrowing bearish divergence (-0.1764), suggesting weakening downward pressure. With the price hovering NEAR the upper Bollinger Band ($127.30), Robert from BTCC notes: 'A sustained break above $123 could trigger FOMO buying, targeting the $130–$135 resistance zone.'

Institutional Demand and ETF Hype Fuel LTC's 15% Weekly Surge

Litecoin's breakout past $123 aligns with bullish headlines: institutional inflows, Bitcoin's rally to $120K, and ETF speculation. Robert at BTCC observes: 'The $124 surge reflects tangible demand, not just hype. If ETF rumors materialize, $150 becomes plausible by Q4.' Market sentiment is overwhelmingly positive, with technicals and news reinforcing each other.

Factors Influencing LTC’s Price

Litecoin (LTC) Targets Major Gains After $123 Breakout Fueled by Institutional Demand

Litecoin has surged past $123, marking a pivotal moment for the cryptocurrency often overshadowed by Bitcoin and Ethereum. Institutional interest is growing, driven by Litecoin's status as a CFTC-recognized commodity and its proven utility as a payment network. MEI Pharma's $100 million investment—acquiring 929,000 LTC at an average price of $107.58—has sparked a 40% jump in open interest, defying broader market declines.

Regulatory clarity continues to bolster Litecoin's appeal. The CFTC's classification provides a framework for institutional adoption, positioning LTC as a secure, regulation-friendly asset. Trading at $123.47, up 1.74% in 24 hours, Litecoin's breakout reflects sustained buying pressure and long-term conviction from major investors.

Crypto Market Extends Rally as Bitcoin Breaks $120,000

Bitcoin surged past $120,000 early Monday, buoyed by ETF inflows, Federal Reserve rate cut expectations, and a bullish technical pattern. The flagship cryptocurrency gained nearly 3% in 24 hours, peaking at $121,981.

Ethereum broke through $4,000 over the weekend, with analysts anticipating new all-time highs. ETH posted a 23% weekly gain before settling at $4,300. Solana maintained strength above $180, while Chainlink outperformed with a 4% rise.

The rally showed broad participation with Hedera, Litecoin, and Polkadot posting notable gains. Only Toncoin and Stellar bucked the trend, trading in negative territory.

Market sentiment strengthened as institutional interest converged with favorable macro conditions. The advance comes amid political developments in crypto policy, including the resignation of White House digital assets advisor Bo Hines.

XRP Trader Earns $9,800 Daily via Sol Mining Amid Ripple's Legal Breakthrough

Ripple's XRP surged 11.1% weekly to $3.38 following a pivotal legal development. The SEC and Ripple jointly moved to dismiss their long-standing appeal in the Second Circuit Court, potentially concluding a five-year regulatory battle that has weighed on the token.

Beyond price speculation, holders are increasingly prioritizing yield-generation strategies. SolMining's cloud-based contract service enables passive income by staking idle XRP—requiring no hardware, with daily automated payouts. The platform supports multi-currency deposits including XRP, BTC, and DOGE, offering flexible contract terms.

Market participants view Ripple's legal progress as a catalyst for renewed institutional interest. 'Regulatory clarity removes the Sword of Damocles,' noted a Singapore-based OTC trader, while arbitrage desks report heightened demand for XRP derivatives on Binance and Bybit.

Litecoin (LTC) Surges Past $124 as ETF Speculation and Institutional Interest Drive Bull Run

Litecoin's price rally continues unabated, breaching the $124 mark with a 4.11% gain as institutional interest and ETF speculation fuel momentum. The cryptocurrency now trades at $124.81, buoyed by MEI Pharma's $100 million treasury allocation and growing adoption on payment platforms.

Technical indicators suggest sustained bullish momentum, with the RSI at 67.50 avoiding overbought territory. The recent block halving event has further strengthened network fundamentals, pushing the hashrate to a record 2.54 PH.

Market sentiment mirrors Bitcoin's ETF-driven rallies, with Litecoin positioning itself as a prime candidate for institutional adoption. CoinGate data shows LTC now commands 14.5% of crypto payment volume, underscoring its utility beyond speculative trading.

How High Will LTC Price Go?

Based on current technicals and market catalysts, LTC could rally toward $150 by year-end. Key levels to watch:

| Scenario | Price Target | Catalyst |

|---|---|---|

| Bullish | $135–$150 | ETF approval + BTC rally continuation |

| Base Case | $125–$135 | Current uptrend holds |

| Bearish | $110 (support) | Market-wide correction |

Robert emphasizes: 'The $123 breakout is critical – sustained volume here confirms institutional participation.'